USAA Renters Insurance: Comprehensive Guide for Peace of Mind

USAA Renters Insurance: Comprehensive Guide for Peace of Mind

USAA Renters Insurance: Comprehensive Guide for Peace of Mind

If you're a renter, protecting your personal belongings is crucial, and USAA renters insurance is often considered one of the best options available — especially for military members and their families. In this in-depth guide, we’ll cover everything you need to know about USAA renters insurance, from its coverage and benefits to costs and frequently asked questions. Let’s dive in!

What is USAA Renters Insurance?

USAA (United Services Automobile Association) offers a range of financial services, including renters insurance tailored primarily for active-duty military members, veterans, and their families. USAA renters insurance covers personal belongings, liability, and additional living expenses, ensuring renters have peace of mind in case of unexpected events.

Why Choose USAA Renters Insurance?

USAA stands out from other insurance providers for several reasons:

-

Exclusive Access: USAA is dedicated to military members and their families, offering specialized coverage for their unique needs.

-

Comprehensive Coverage: Includes personal property, liability, loss of use, and medical payments to others.

-

Flood and Earthquake Protection: Unlike most providers, USAA includes coverage for floods and earthquakes at no extra cost.

-

Affordable Rates: USAA’s premiums are highly competitive, with policies starting at just a few dollars a month.

-

Exceptional Customer Service: USAA consistently receives high ratings for customer satisfaction.

What Does USAA Renters Insurance Cover?

USAA renters insurance offers robust coverage for a variety of situations. Here’s a closer look:

-

Personal Property Coverage: Protects belongings like furniture, electronics, clothing, and valuables from theft, fire, vandalism, and natural disasters.

-

Liability Coverage: Covers legal expenses if someone is injured in your rental or if you accidentally damage someone else’s property.

-

Loss of Use: Pays for temporary housing and other expenses if your rental becomes uninhabitable.

-

Medical Payments to Others: Covers medical expenses if a guest is injured in your home.

-

Flood and Earthquake Coverage: Uncommon in standard policies, this coverage is automatically included with USAA renters insurance.

How Much Does USAA Renters Insurance Cost?

USAA renters insurance is known for its affordability. The cost varies based on factors like location, coverage limits, and deductible. On average, policies range from $10 to $25 per month, with customizable options to fit your budget and needs.

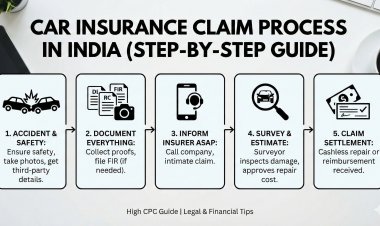

How to Get USAA Renters Insurance

Getting insured with USAA is a simple process:

-

Check Eligibility: Ensure you qualify for USAA membership (military members, veterans, and their families).

-

Get a Quote: Visit the USAA website or app to receive a personalized quote.

-

Customize Your Coverage: Select the right coverage limits and deductible for your situation.

-

Purchase Your Policy: Finalize your policy online or over the phone with a USAA representative.

-

Manage Your Policy: Use the USAA app to handle claims, payments, and updates to your policy.

Pros and Cons of USAA Renters Insurance

Pros:

-

Affordable premiums.

-

Covers floods and earthquakes.

-

Excellent customer service.

-

Tailored for military members and their families.

Cons:

-

Membership is limited to military members, veterans, and their families.

-

Some coverage options may be unnecessary for non-military renters.

Frequently Asked Questions (FAQ)

Q: Who is eligible for USAA renters insurance? A: Active-duty military members, veterans, and their immediate families are eligible.

Q: Does USAA renters insurance cover roommates? A: No, each roommate needs their own policy.

Q: Can I get coverage if I’m deployed overseas? A: Yes, USAA covers personal property even when stationed abroad.

Q: How do I file a claim? A: Claims can be filed online, through the USAA app, or by calling a representative.

Q: Does USAA renters insurance cover high-value items? A: Yes, but you may need additional coverage for items like jewelry, art, or collectibles.

Is USAA Renters Insurance Worth It?

If you’re eligible, USAA renters insurance is an exceptional value. Its affordable premiums, comprehensive coverage, and unique benefits — like flood and earthquake protection — make it a standout choice.

Final Thoughts

For military members, veterans, and their families, USAA renters insurance is a top-tier option. With its affordable pricing, comprehensive coverage, and excellent customer service, it’s no wonder USAA consistently ranks as one of the best renters insurance providers. If you’re eligible, getting a quote is a smart first step towards protecting your belongings and gaining peace of mind.

Ready to protect your rental with USAA? Visit their website and get a personalized quote today!